This article was featured in our 2023 Energy Arbitration Report, which is part of a series of industry-focused arbitration reports edited by Jus Connect and Jus Mundi.

This issue explores the energy industry, encompassing information on electricity & renewables, based on data available on Jus Mundi and Jus Connect as of September 2023. Discover updated insights into energy arbitration and exclusive statistics & rankings, as well as in-depth global and regional perspectives on energy projects, disputes, & arbitration from leading lawyers, arbitrators, experts, arbitral institutions, and in-house counsel.

THE AUTHOR:

Leslie Zhang, General Counsel & Vice President Strategic Growth and Business Development, United Energy Group

Trends of Energy Disputes at The SCC Arbitration Institute Between 2020 and 2023

In recent years, led by the United Nations and various other international organizations, countries around the globe have embarked on ambitious campaigns to develop renewable energy and fight climate change. Meanwhile, a succession of major black swan events, first the Covid-19 pandemic and then the Russia–Ukraine Conflict, have sent shockwaves through the global energy market and led to a severe energy crisis. These profound changes have far-reaching impact on energy-related disputes in China. With the steady progress of energy transition, an increasing number of disputes have arisen from the new energy sector. Additionally, amidst the chaos due to the Covid-19 pandemic and the Russia- Ukraine Conflict, and the tightened regulations aiming at achieving both “energy security” and an “orderly transition” to a low-carbon energy system, certain interesting new trends or causes of disputes have also begun to unfold.

Rise of Disputes from the New Energy Sector

With the expansion of renewable energy in China, disputes from the new energy sector have been on the rise, and the new energy sector seems to be poised to overtake its conventional counterpart as the predominant source for energy disputes.

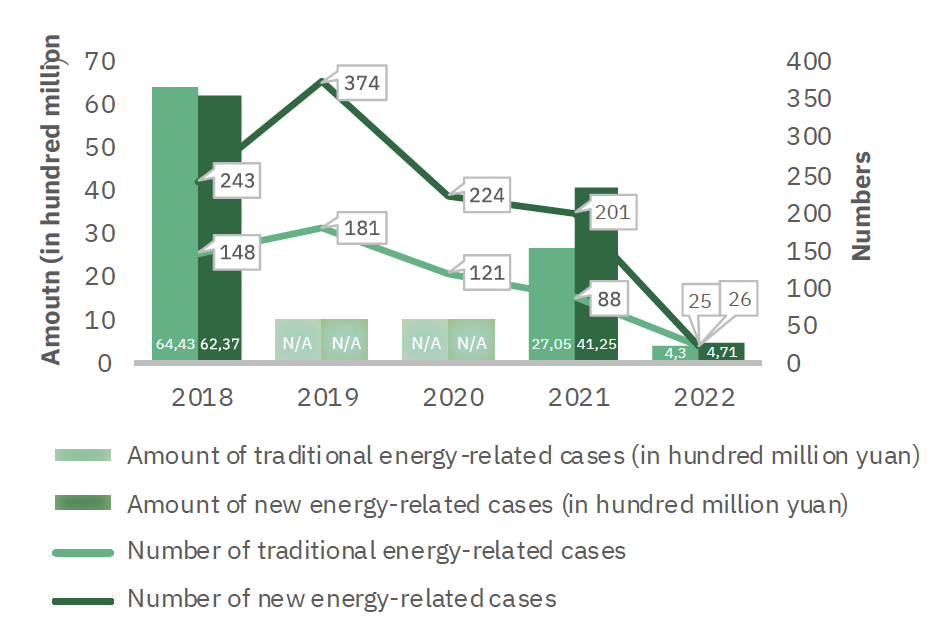

According to its casework statistics, Beijing Arbitration Commission, a major arbitral institution of China, has consistently dealt with more cases from the new energy sector than the conventional energy sector in the past 5 years, and more recently, the total amount of disputes from the new energy sector disputes has also surpassed those from the conventional energy sector.

(the total disputed amount for cases in 2019 and 2020 are unavailable)

New Trends or Causes for Energy Disputes

Disputes Arising From Dislocation of the Energy Market

Since 2019, the Covid-19 pandemic and the Russia-Ukraine Conflict have significantly destabilized the global energy market. As an integrated part of the global market, China is not immune to the sweeping impact of such events, and the unforeseen and dramatic fluctuations in energy prices have predictably led to various disputes, especially in long-term oil and gas supply contracts. For example, in a recent case adjudicated by a Chinese court, an LNG seller sought exemption from obligations under a sales contract on the ground that the surge in LNG prices following the Russia-Ukraine Conflict constitutes a force majeure. The court denied the seller’s request, noting that the seller was a veteran LNG supplier familiar with the market, and that LNG prices had been steadily rising before the parties signed the LNG sales contract, which indicated the subsequent increases in LNG prices were a commercial risk the seller had assumed, rather than force majeure. Similar cases have been raised during the Covid-19 pandemic as well. In such cases, contracting parties usually cite force majeure or the changed circumstances doctrine to request for exemption from obligations that have become onerous. As of now, the prospect of the Russia-Ukraine Conflict is uncertain, with no clear end in sight, and the global energy market remains volatile and fragile. We may see more disputes caused by the fluctuations in the energy market in the near future.

Dispute from M&A Transactions

M&A transactions in the energy sector typically involve significant financial stake and complex deal structures. In recent years, increased market risk has led Chinese companies to become increasingly proactive in wielding litigation or arbitration as leverage for their business objectives, especially in cross-border energy M&A transactions. Also, given the uncertainty of energy prices, earnout payments have become more popular in energy M&A transactions, especially in the oil and gas industry, where the parties tie payments for target assets to oil or gas prices, reserves or the assets production or performance following the completion of the transactions. As the earnout mechanism essentially converts the M&A transactions into an ongoing concern, instead of a clean-off one-time deal, its growing popularity may lead to more disputes.

Disputes Relating to Carbon Emission

To achieve a carbon emission peak by 2030 and carbon neutrality by 2060, the Chinese government has introduced numerous new legislations and policies, including a comprehensive carbon emission quotas system. New disputes relating to carbon emissions have surged in recent years. Pursuant to the report from the Supreme People’s Court of China (“Supreme Court”), courts across the nation have adjudicated more than one million carbon emission cases since China joined the Paris Accord.

In a recent exemplary case published by the Supreme Court, the court confirms that carbon emission quotas are a property of value, similar to deposits, cash, motor vehicles and real estate. With the recognition of the legal status and value of carbon emission quotas, disputes concerning carbon emissions are very likely to become a material subject for commercial disputes.

Disputes Concerning Intellectual Property Rights

The new energy sector relies heavily on technological innovations, and its expansion has given rise to a significant number of intellectual property disputes. As noted in the Supreme Court’s annual reports on intellectual property disputes in 2020 and 2021, the new energy sector has become one of the main sources of intellectual property infringement claims in China. The further development of the new energy sector requires extensive research and innovations, which may bring forth even more intellectual property disputes.

Conclusion

In light of the prevailing consensus on climate change, and the persisting energy crisis, the energy sector of China will continue to be affected by the profound changes that have already partially shifted the landscape of the industry. In the next years, the volatile energy market, carbon emissions goals, and ESG liabilities are likely to cause more energy disputes. While courts in China are likely to play a significant role in resolving such disputes, we expect an increase in conflicts that will end up in arbitrations. Chinese arbitral institutions would have to ramp up their arsenal for handling energy disputes, by increasing the number of arbitrators with expertise in domestic and international energy practices and accumulating experience administering energy disputes, in order to play a more meaningful role in the resolution of energy disputes.

ABOUT THE AUTHOR

Mr.Zhang currently holds the position of General Counsel and Vice President of Strategic Growth and Business Development at United Energy Group Limited (UEG). Prior to joining UEG, he served as a Director in the Project Management Division of the Legal Department at China National Offshore Oil Corporation. He has played an integral role in numerous groundbreaking transactions in the oil and gas sector globally, possessing a comprehensive grasp of energy disputes in both theory and practice. Furthermore, Leslie Zhang is a visiting professor at several esteemed universities and sits on the board of directors for a public company. He is also on the list of arbitrators registered with the Beijing Arbitration Commission/Beijing International Arbitration Centre (BAC/BIAC).

Find more data-backed insights in our 2023 Energy Arbitration Report