THE AUTHOR:

Isabelle Wenger, Associate at Stephenson Harwood

On 30 January 2023, the International Centre for Settlement of Investment Disputes (“ICSID“) published its latest issue of ‘The ICSID Caseload – Statistics’ (the “Report“), showcasing trends for 2022 and comparative data dating back to the institution’s inception in 1966.

This article discusses:

A. ICSID’s caseload;

B. The basis of consent;

C. Geographic distribution;

D. Diversity of appointments;

E. Economic sectors; and

F. Outcomes of ICSID arbitrations.

A. ICSID’s Caseload

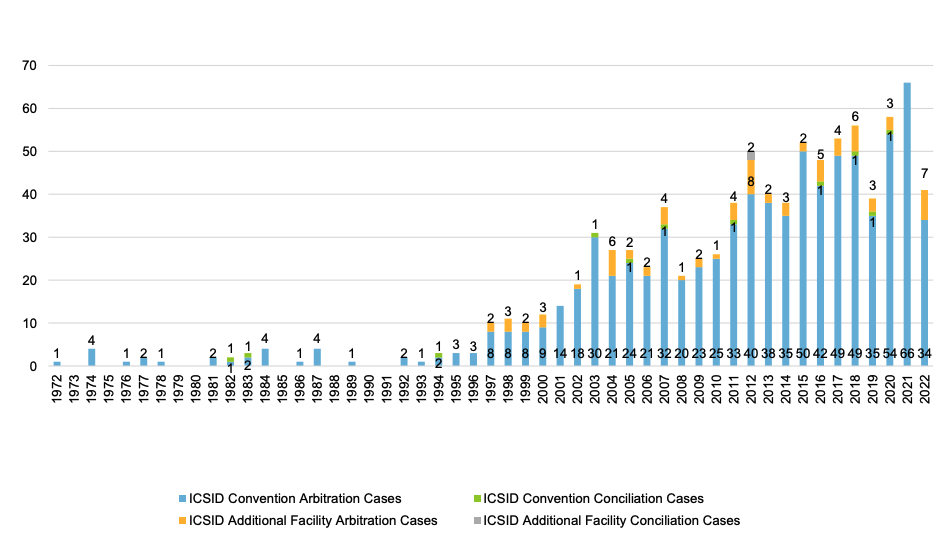

According to the Report, a total of 41 new cases were registered in 2022. This is a significantly lower caseload than that recorded the year before (66 cases) and in 2020 (58 cases) yet is comparable to the numbers reported in 2019.

All cases recorded in 2021 were ICSID Convention arbitration cases, while only 34 cases were classified in this way in 2022, the remaining 7 cases being ICSID Additional Facility arbitrations.

Further, while at least one conciliation case was recorded each year between 2018 and 2020, this “upwards” trajectory came to a halt from 2021 onwards.

We can therefore see a few trends:

- The number of cases registered by ICSID in 2022 has returned to pre-pandemic levels. Covid-19 may no longer be a global health emergency and economies have started to recover from its effects, but the pandemic left a mark in the form of supply chain disruptions, delayed or cancelled construction and energy projects, and volatile commodity prices. We therefore anticipate that the aftershocks of Covid-19 will result in a fresh influx of ICSID arbitrations;

- There is an increasing use of the ICSID Additional Facility, which applies where one, or neither, of the parties is (a national of) an ICSID Member State. Together with non-ICID cases being continuously registered by the Secretariat, this demonstrates a tendency to use ICSID’s services even when there is little to no link with the institution itself; and

- The lack of conciliation cases aligns with the view that the ICSID conciliation procedure is perceived as a quasi-failure. This is interesting when considered against parties’ willingness to settle once arbitrations have commenced, which is explored in section F of this article.

B. Basis of Consent

The dominance of Bilateral Investment Treaties (“BITs“) continues, with 54% of all cases registered in 2022 invoking BITs as the basis of parties’ consent and accords with the 60% figure recorded on average since 1966.

The Energy Charter Treaty (“ECT“) was invoked in 22% of the cases. Most of these arbitrations (other than annulment cases) were registered in the last quarter of 2022, which corresponds to the time when:

- Belgium, France, Germany, Luxembourg, the Netherlands, Slovenia, Spain, and Poland announced their intention to withdraw from the ECT;

- A modernised, greener version of the ECT was to be voted on; and

- The European Parliament passed a resolution calling on the European Commission and the Member States to prepare “a coordinated exit from the ECT“.

The resulting uncertainty comes amidst energy transition issues such as decommissioning, and the war in Ukraine impacting global energy supplies, all of which present significant challenges for energy sector participants. This is likely to continue resulting in claims based on the ECT, and in energy-related sectors, as discussed in section E of this article.

Besides investment contracts between the investor and the host State, which places third at 12%, several regional trade agreements were relied upon as the basis of consent, including:

- The United States-Mexico-Canada Agreement. This replaces the North American Free Trade Agreement, whose sunset period ends in June 2023 and some claims relating to which required notification by the end of 2022; and

- The ASEAN-China Investment Agreement 2009. The significant time between its ratification and the first ICSID case being brought under it in 2021 is explained by the fact that investor-State dispute claims against China are rare, and BITs tend to be relied on by Chinese investors seeking relief from foreign States.

C. Geographic Distribution

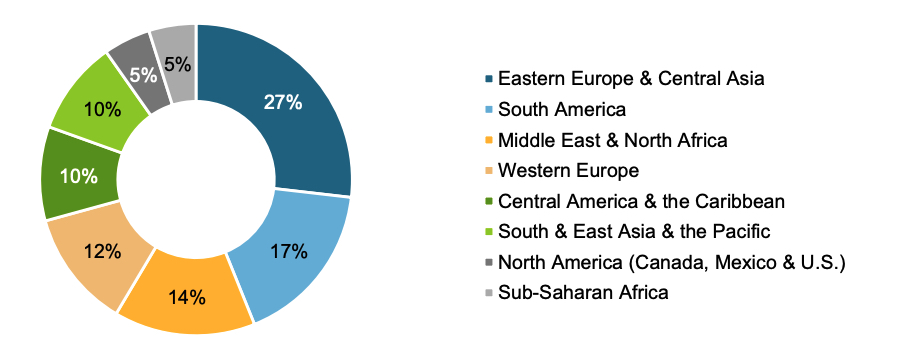

The first “I” in ICSID, being its international character, is reflected in its 2022 caseload, with parties involved in the 41 cases registered being spread across 34 different countries.

The emphasis on Eastern Europe and Central Asia remains at 27%, with Slovenia and Romania both having three arbitrations registered against each of them and Bulgaria having two.

Venezuela also had three arbitrations brought against it, though this did not greatly impact cases involving a South American State, which reduced from 22% to 17%. This may soon change, however, in light of recent commitments made by Colombia and Ecuador to the ICSID system, and the political reforms that took place in 2022, most notably, in Chile, Colombia, Peru, and Honduras.

A stark decrease is also seen in the number of cases involving a sub-Saharan African country. Historically, this would constitute approximately 14% of all ICSID cases, though only accounts for a meagre 5% in 2022, with 1 case being registered against Cameroon and Senegal, respectively. Perhaps the low number of cases against African States incentivised Angola to become the only new signatory to the ICSID Convention in 2022. Indeed, it was the 50th African country to ratify the ICSID Convention, with only Equatorial Guinea, Eritrea, Libya, and South Africa not yet members.

The least amount of change is reported in the Middle East & North Africa (“MENA“), Western Europe, South and East Asia and the Pacific, and Central America and the Caribbean regions, with cases registered against countries in these regions only increasing by a few percentage points, whilst North America remains at 5%.

D. Diversity of Appointments

The Report sets out statistics relating to the diversity of arbitrators, conciliators, and ad hoc committee members (the “Appointees“) appointed in ICSID cases in 2022.

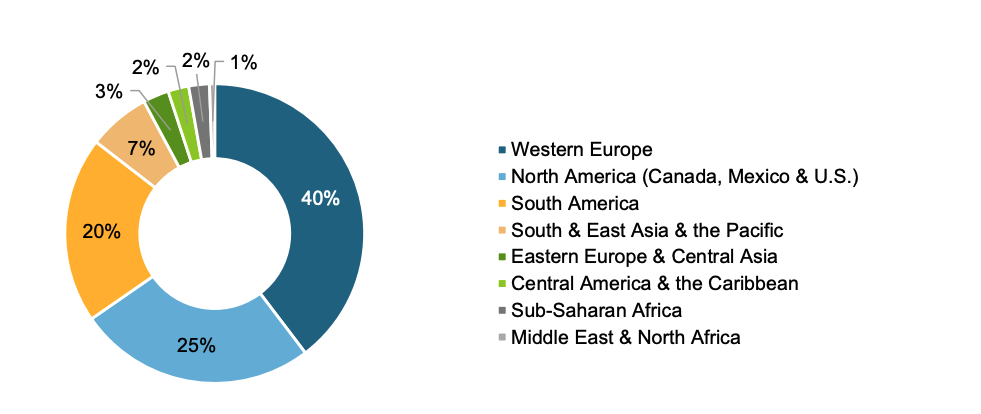

In terms of geographic diversity, there is room for improvement with almost two thirds of Appointees coming from Western Europe (40%) and North America (25%). South America places third with 20%; indeed, Argentina was ranked the fifth most common nationality of Appointees in 2022.

However, several nationalities are extremely underrepresented, with those from South and East Asia and the Pacific appointed in only 7% of cases, while the percentage of Appointees from Eastern Europe and Central Asia, Central America and the Caribbean, and sub-Saharan Africa remains unchanged between 2% to 3%. In an even worse position are those from the MENA region, who were previously involved in 4% of ICSID cases, but only 1% in 2022.

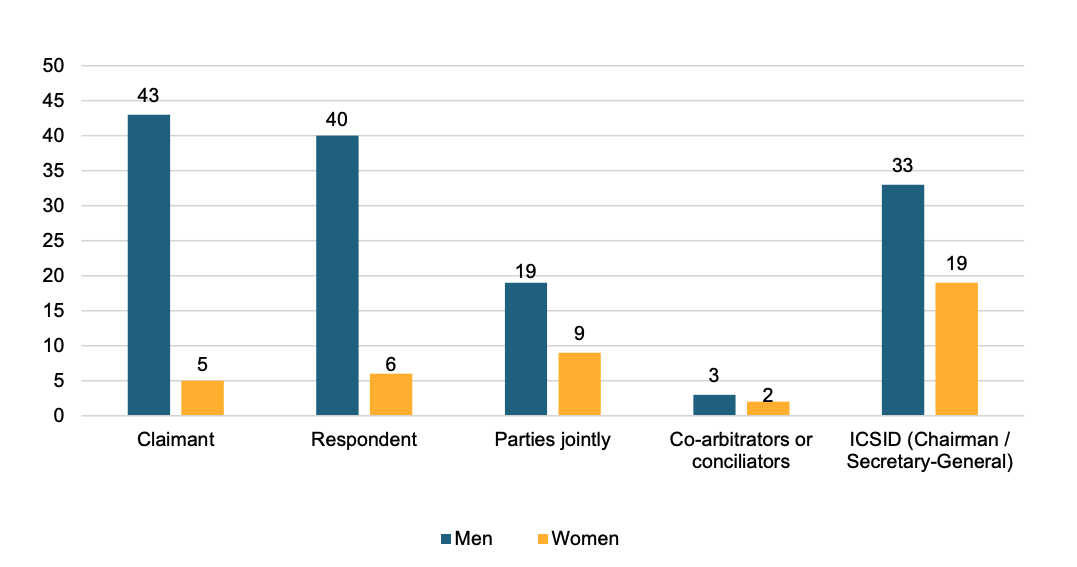

Gender diversity statistics are equally discouraging; women were only appointed in 23% of cases, which signifies a return to 2020 figures. The highest number of male Appointees and the greatest gender imbalance can be attributed to claimants (who appointed 43 men compared to 5 women), while ICSID appointed the greatest number of women and is solely responsible for females Appointees in Central American and Caribbean, sub-Saharan African, and MENA cases. There is a feeling that greater efforts in this respect need to be made, and it awaits to be seen whether this downward trend will be reversed in 2023.

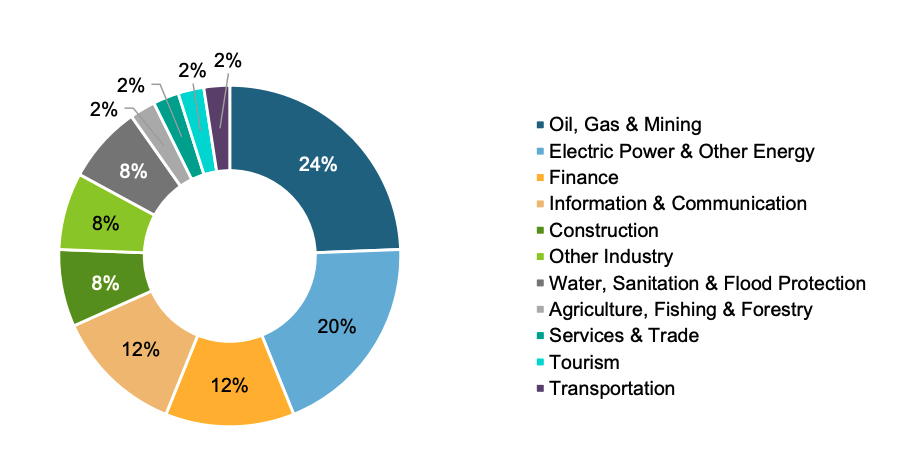

E. Economic Sectors

Oil and gas continue to account for almost a quarter of all ICSID cases registered in 2022, while the energy sector places second with 20%. This ties back to the developments discussed in section B of this article.

Unlike historic trends, however, cases relating to finance and information and communications each account for 12%, overtaking the construction sector, which only scores 8%. This is not surprising given that some of 2022’s hottest topics were the metaverse, the “Crypto Winter”, and artificial intelligence.

The impact of other issues like global warming can also be seen by virtue of water, sanitation and flood protection cases doubling, while Covid-19 likely contributed to agriculture, tourism, and service-related cases virtually halving in 2022.

F. Outcomes

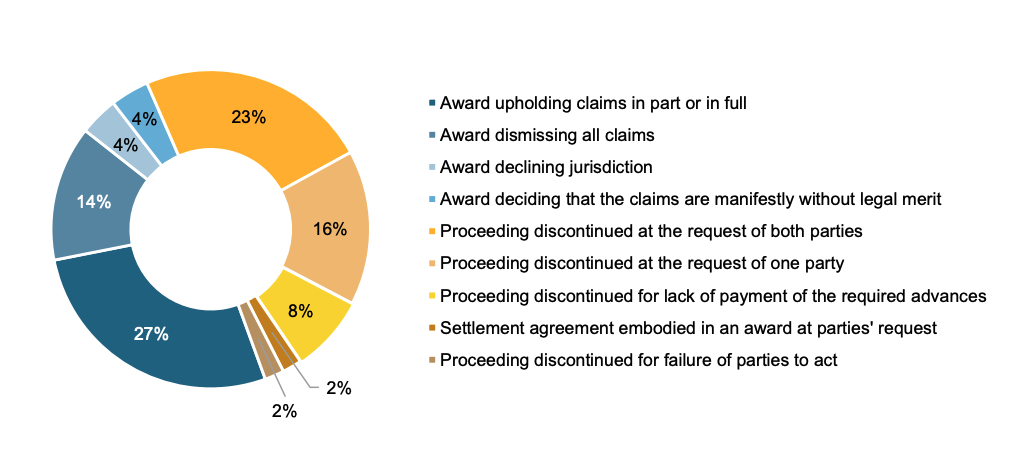

Whilst 36% of ICSID cases usually settle or are discontinued, this statistic increased drastically to 51% in 2022. When considered against the continued unpopularity of conciliation as a settlement mechanism, this development seems counterintuitive; why do parties prefer to commence expensive and time-consuming arbitrations when it is ultimately a settlement agreement, instead of an arbitral award, that resolves the dispute?

Nonetheless, the parties’ willingness to do so is reflected in settlements being requested by one or both parties in 39% of all ICSID cases registered in 2022. Tribunals were less involved, with settlement agreements being embodied in awards at the parties’ request less than in previous years (only 2%) and discontinuances not occurring on tribunals’ initiatives at all.

The 49% of cases that were decided by tribunals maintain the balance between investors and States that ICSID has previously been criticised for lacking. Indeed, investors’ claims were upheld fully or partially in 27% of all cases registered in 2022, whilst tribunals ruled in favour of the State in the remaining cases by dismissing the investors’ claims (14%), declining jurisdiction (4%) or finding that the investors’ claims were manifestly without legal merit (4%).

It will be interesting to see the extent to which the next ICSID report, which is due to be published this summer, will show that the trends described above have continued into 2023.

ABOUT THE AUTHOR:

Isabelle Wenger is a newly qualified associate at Stephenson Harwood‘s international arbitration team. Her particular interest in investment treaty disputes was sparked during the Master of Laws programme in international dispute resolution that Isabelle completed with distinction and is reflected in the publications she has contributed to, including Volume 19 of the ICSID Reports. She is also an unregistered barrister and was called to the Bar of England and Wales in 2019.

All the data in this article was obtained from “The ICSID Caseload – Statistics” for the year of 2022.