This ranking was featured in our 2023 Construction Arbitration Report, which is part of a series of industry-focused arbitration reports edited by Jus Mundi and Jus Connect.

This issue explores the construction industry and presents a goldmine of information based on data available on Jus Mundi and Jus Connect as of May 2023. Discover updated insights into construction arbitration and exclusive statistics & rankings, as well as in-depth global and regional perspectives on construction projects, disputes, & arbitration from leading lawyers, arbitrators, experts, arbitral institutions, and in-house counsel.

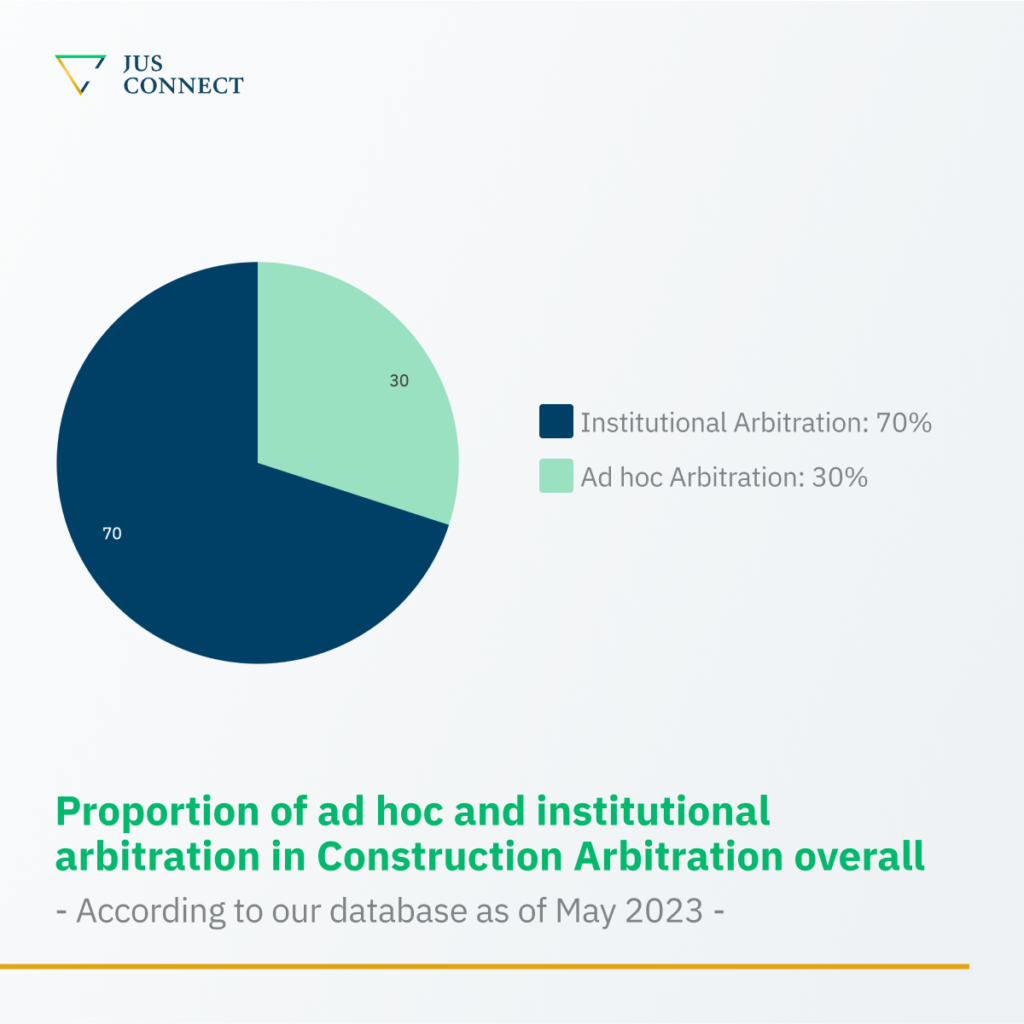

Ad hoc arbitration is extremely popular in the construction sector. It surpasses any arbitral institution, according to our data. This can be ex- plained by several factors, both typical to the choice of ad hoc arbitration and more specific to the construction sector:

- Ad hoc arbitration is said to be more cost-effective than institutional arbitration due to the absence of administrative fees. That being said, administrative fees are usually not the main cost center of an arbitration.

- Removing this administrative layer means parties have to bear the administrative burden of their arbitration. Parties familiar with arbitration, which is often the case in the construction sector, do not find this to be a disadvantage.

- They can tailor the arbitral process to their needs, interrupt it to attempt to negotiate a settlement, or use other ADR methods, even multiple times during the process if they so wish.

Key Takeaways

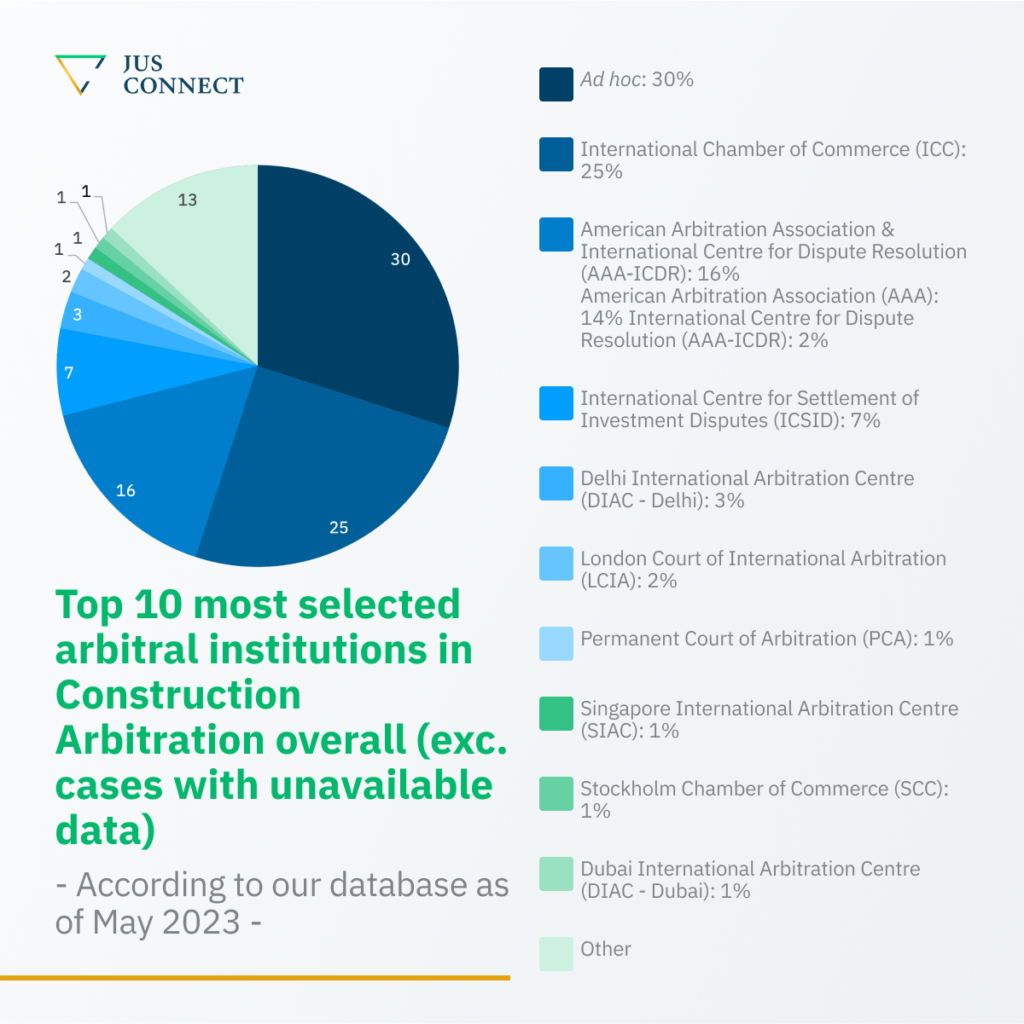

The Top 3 arbitral institutions – namely the International Chamber of Commerce (ICC), the American Arbitration Association & International Centre for Dispute Resolution (AAA-ICDR), and the International Centre for Settlement of Investment Disputes (ICSID) – administered 48% of all construction arbitration cases available on Jus Mundi.

For the first time in our series of Industry Insights Reports, the Delhi International Arbitration Centre (DIAC – Delhi) enters our data-backed ranking of the most selected arbitral institutions. According to our data, DIAC – Delhi exclusively administered commercial arbitration cases in the construction sector.

This addition to our ranking is not so surprising: the construction industry in India has been growing exponentially in the last few years. The Indian government has launched multiple initiatives to further increase the infrastructure sector’s growth, including a 1.2 trillion national plan for infrastructure. The Indian construction sector significantly contributes to the country’s GDP and is one of the fastest-growing industries in the country.

More investments tend to lead to more disputes. Arbitration has therefore emerged as a preferred dispute resolution method in the construction field in the country.

Recent amendments in 2015, 2019, and 2021 to the Arbitration and Conciliation Act 1996 certainly contributed to the development of arbitration in India. Read more about these updates in Recent Amendments in Indian Arbitration and Conciliation Act: The Winds of Change Have Begun to Blow for the Resolution of Complex Construction Disputes, by Prateek Jain (Masin).

While ICC has administered both commercial and investor-State arbitrations in the construction field over the years, its caseload is more commercial in construction arbitration. In the last ten years, it administered 393 commercial arbitration cases in the sector and a mere 25 investor-State cases, according to our data.

On the contrary, ICSID remains the predominant investor-State ar- bitration institution, including in the construction industry. According to our data, ICSID administered 57.5% of all investor-State arbitrations in the construction sector. This number is relative, however: it represents only 7% of all construction cases on our database, which makes the insti- tution far behind ICC and AAA-ICDR in terms of construction caseload.

Although ICSID is a staple of the ISDS regime, the regime itself has come under increasing criticism in the last decade, so much so that it has been said to be facing a legitimacy crisis. This was supposedly the reason Bolivia and Venezuela denounced the ICSID Convention in 2007 and 2012 respectively, as well as Ecuador in 2009 (which ended up signing the ICSID Convention again in 2021). It also led to the demise of the in- tra-EU ISDS system in the wake of the CJEU landmark decision in Slovak Republik v Achmea BV.

The amendment of the ICSID Rules and Regulations –which entered into force earlier last year on July 1, 2022– has therefore been a welcomed development in addressing the ISDS regime’s legitimacy crisis. Among other changes, the Rules now provide for greater transparency, which is essential, as noted by the tribunal in Vivendi v. Argentina (II): “public acceptance of the legitimacy of international arbitral processes, particularly when they involve states and matters of public interest, is strengthened by increased openness and increased knowledge as to how these processes function” (para. 22).

Most recently, ICSID registered a claim by Autopistas del Atlántico (Ada- sa) and five other claimants against Honduras regarding the early ter- mination of a contract for the ‘Tourist Corridor’, a project to develop and rehabilitate highway infrastructure across several regions of the North coast of the country. On June 2, the arbitral tribunal was partially com- posed (See, Autopistas del Atlántico and others v. Honduras).

According to The ICSID Caseload – Statistics, Issue 2023-1, 10% of its all-time caseload (i.e., 1966-202) was composed of construction cases, and only 8% in 2022.

The Permanent Court of Arbitration (PCA), which comes in third, also predominantly manages investor-State arbitrations in the construction sector.

According to our data, only 7 arbitral institutions have dealt with in- vestor-State arbitration cases in the construction field. For most, thesecases were odd occurrences. For instance,

- Stockholm Chamber of Commerce (SCC), only dealt with a handful of investor-State cases in construction in the last ten years. In the last two years, only the aforementioned top 3 institutions have administe- red investor-State arbitrations in construction, according to our data.

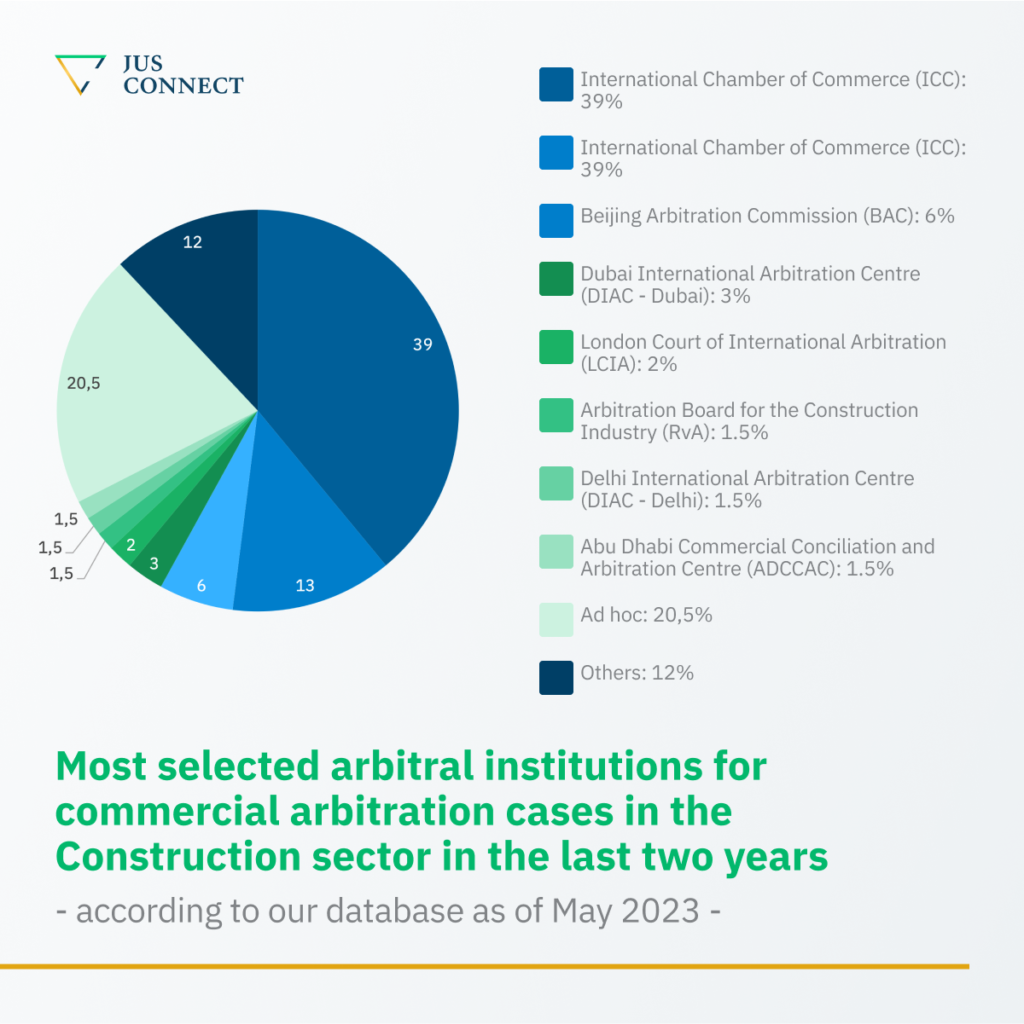

Unlike in investor-State arbitration cases in construction, a diversity of arbitral institutions are involved in commercial arbitration of construction disputes around the world. In the last two years alone, 27 institutions have administered commercial construction arbitrations, according to our data.

European Insights

ICC is, by far, the top arbitral institution in commercial arbitration of construction disputes. It administered 25% of all construction arbitra- tions cases available on Jus Mundi and 39% of all construction cases filed in the last two years.

In 2022 and up to May 2023 only, out of 231 construction arbitration cases filed and available on Jus Mundi, 216 are commercial arbitrationcases, including 76 administered by ICC

ICC highly benefits from the fact that FIDIC’s three main standard form contracts (i.e., the Red Book, Yellow Book, and Silver Book) – which are staples in the construction industry -, provide for disputes to be de- termined by binding adjudication in the first instance, followed by ICC arbitration if a party is dissatisfied with the adjudication determination. Therefore, unless otherwise agreed by the parties, their default dispute resolution clause refers them to ICC to arbitrate their construction dispute.

Discover more from the institution itself in Construction Arbitration at ICC, by Elina Zlatanska (International Chamber of Commerce (ICC)).

– In its 2022 Annual Casework Report, LCIA reports that construction cases represented 5% of its caseload.

APAC Insights

Asian institutions are on the rise:

- The Beijing Arbitration Commission (BAC) is a rising arbitral institution in the building industry, according to our data. It became the third most popular arbitral institution in the sector in the last two years.

- HKIAC reports 9.9% of its caseload is composed of construction cases in its 2022 Statistics, which is a slight increase compared to 2021.

- In its 2022 Statistics, SIAC reported that construction cases repre- sented 11% of its caseload.Discover more about construction arbitration in the region from an institution in Construction Arbitration in SHIAC and the Outlook, by Weijun Wang & Tingwei Li (Shanghai International Arbitration Center (SHIAC)).

North American Insights

AAA-ICDR is the reference to arbitrate construction disputes in the United States but also internationally. The institution provides arbitral rules specifically dedicated to construction disputes, the Construction Rules and Mediation Procedures.

According to its data, AAA administered 3,713 domestic construction cases and ICDR administered 55 international construction cases in 2022 alone.

Learn more about construction arbitration in the USA from the institution itself in Domestic and International Construction at AAA-ICDR, by Luis M. Martinez, Michael A. Marra & Aisha Nadar (American Arbitration Associa- tion – International Centre for Dispute Resolution (AAA-ICDR)).

MENA Insights

Dubai International Arbitration Centre (DIAC – Dubai) is MENA’s most selected arbitral institution.

The construction sector is one of the most dynamic in the region, especially in the United Arab Emirates and in Saudi Arabia. The industry contributes to about USD 45.5 billion to Saudi Arabia’s GDP and USD 36.8 billion to United Arab Emirates’s GDP. Qatar has also significantlyincreased its activity in the sector with the infrastructure developments required to host the 2022 World Cup.

Arbitral institutions in the region are, therefore, growing their caseload. To learn more, get the institutional insights in Resolving Construction & Infrastructure Disputes in ‘Arbitration-friendly’ Saudi Arabia, by James Macpherson (Saudi Center for Commercial Arbitration (SCCA)).

Find more data-backed insights in our 2023 Construction Arbitration Report